Take Home Pay Calculator Manhattan

If you earn $130,000.00 (or earn close to it) and live in new york, then this will give you a rough idea of how much you will be paying in. Calculating paychecks and need some help?

Get Salary Slip Format In Excel - Microsoft Excel Templates Excel Templates Microsoft Excel Excel

This guide will go over all you need to know from where you'll file, to the most significant benefit of living in new jersey, avoiding the city income tax.

Take home pay calculator manhattan. For the calculation, we will be basing all of our steps on the idea that the individual filing their taxes has a salary of $130,000.00. Supports hourly & salary income and multiple pay frequencies. A salary of $150,000 in charlotte, north carolina should increase to $442,127 in manhattan, new york (assumptions include homeowner, no child care, and.

Overview of new york taxes new york state has a progressive income tax system with rates ranging from 4% to 8.82% depending on taxpayers’ income level and filing status. Calculates federal, fica, medicare and withholding taxes for all 50 states. A family of 4 would find it difficult to make ends meet with a $100k per year household income in manhattan.

That means that your net pay will be $42,787 per year, or $3,566 per month. If you make $55,000 a year living in the region of new york, usa, you will be taxed $12,213. The average rent in manhattan is $4100 according to usa today.

The tax is administered and collected by the new york state department of taxation and. This marginal tax rate means that your immediate additional income will be taxed at this rate. Your average tax rate is 22.2% and your marginal tax rate is 36.1%.

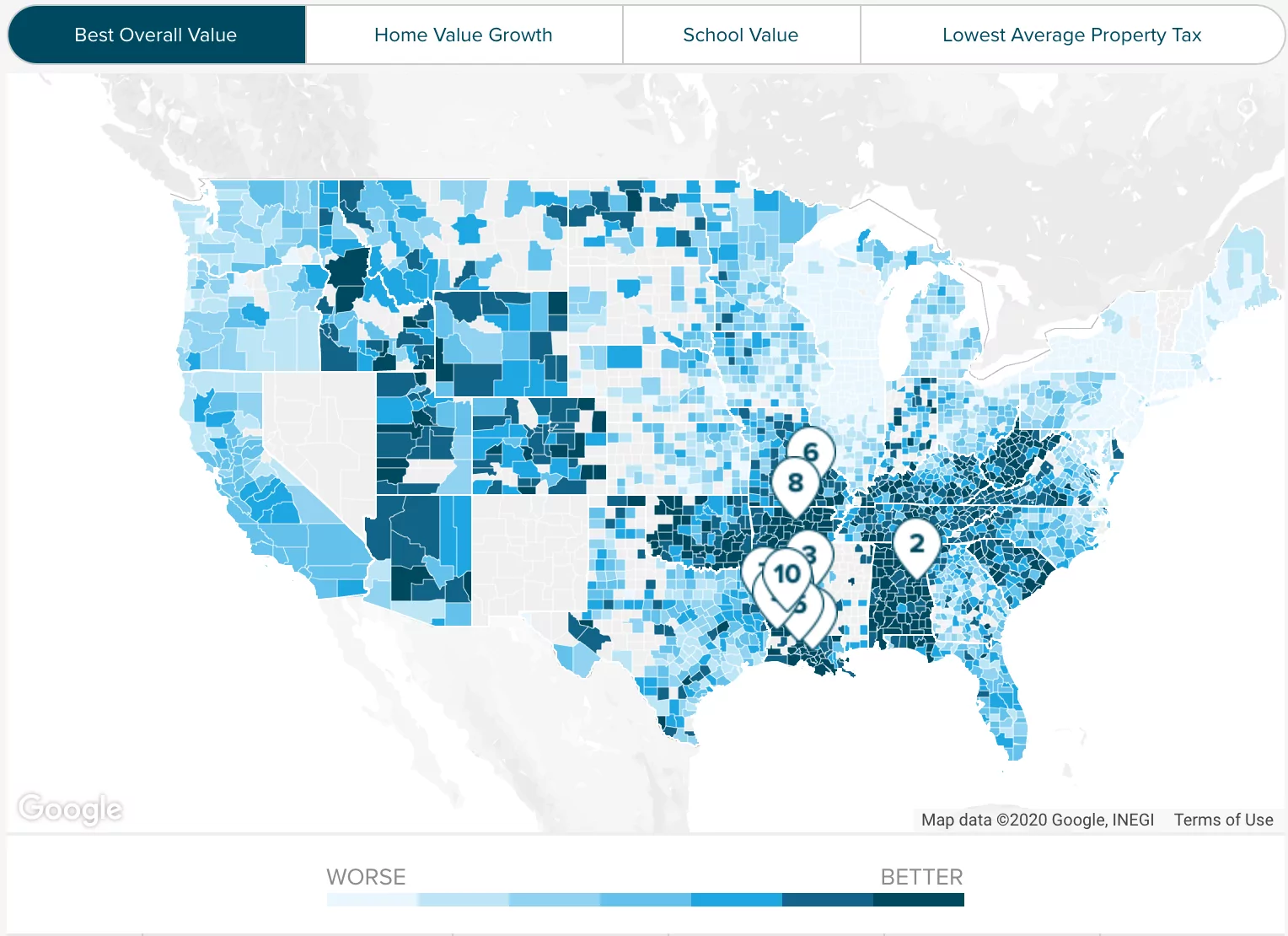

The cost of living is 122% higher in new york (manhattan), ny. If you are going to live in nj and work in nyc, you're probably wondering how you'll be paying taxes. Icalculator also provides historical us federal income tax figures so you can review how much tax you have paid in previous tax years or you can use our salary tax.

You can calculate and compare your take home pay based on each salary. Divide each employee’s annual salary by the number of pay periods you have each year. Make sure to calculate any overtime hours worked at the appropriate rate.

Google employees who move even farther away from the company’s. Live in nj work in nyc taxes. The salary calculator is an excellent tool for identifying how your payroll deductions and income taxes are split up with details of how each is calculated and the.

Property managers typically use gross income to qualify applicants, so the tool assumes your net income is taxed at 25%. Details of the personal income tax rates used in the 2022 new york state calculator are published below the calculator, this includes historical tax years which are supported by the new york state salary calculator. Nyc has a city income.

For married couples filing jointly, the tax rates are the same, but the income brackets are doubled. Input your net (after tax) income and the calculator will display rentals up to 40% of your estimated gross income. Google is slashing pay by up to 25% for some employees who choose to work remotely forever.

That will depend on many factors. Check out our new page tax change to find out how federal or state tax changes affect your take home pay. Even though arkansas residents overall earn less than the average american income, those who take home a.

This free, easy to use payroll calculator will calculate your take home pay. Use this free new york mortgage calculator to estimate your monthly payment, including taxes, homeowner insurance, principal, and interest. If you're single, married and filing separately or a head of a household, you will be taxed at 3.10% on the first $15,000 of taxable income, at 5.25% on the next $15,000 and at 5.70% on all income above $30,000.

If your annual salary is $50,000 and you work 40 hours/week (or 2,088 hours/year), your hourly rate = $50,000 /. To maintain your standard of living in new york (manhattan), ny, you need to earn: San francisco and boston are also the high cost of living areas.

Like the general schedule payscale, which applies to white collar employees, the your pay under fws largely depends on your location (the government installation you work at), your paygrade, and your step. See new york (manhattan)’s complete. See how your monthly payment changes by making updates.

Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes. “if you live in new york city and earn income, you are charged personal income tax. Multiply the number of hours worked in the most recent pay period by their pay rate.

Calculating paychecks and need some help?

New York Paycheck Calculator - Smartasset

Tn7ppimo075w8m

Barneys New York Madison Ave New York Bucket List Nyc Trip High Street Shops

100 App Icons Ios 14 White Strokes Etsy App Icon Homescreen Ios

South Carolina Paycheck Calculator - Smartasset

Ohio Paycheck Calculator - Smartasset

Pin By Laurie Kominek On Important To Me In 2021 Emergency Evacuation Genealogy Records Emergency

Illinois Paycheck Calculator - Smartasset

Heres What Getting A Raise Will Do To Your Taxes

Ios 14 Aesthetic Icons App Black And White Magic Hands Pack Iphone Ios 14 App Icons Android Theme Widget Background In 2021 App Icon Android Theme App

Katzs Deli I Love Nyc Nyc New York

How To Calculate Travel Nursing Net Pay - Bluepipes Blog

Oklahoma Paycheck Calculator - Smartasset

Pin On Ui

Ny Teacher Pension Calculations Made Simple The Legend Group

New York Paycheck Calculator - Smartasset

How To Calculate Travel Nursing Net Pay - Bluepipes Blog

Jefferson County Ky Property Tax Calculator - Smartasset

Google Rolls Out Pay Calculator Which Could Trigger Salary Cut If You Move Far Away From Office Indy100

Ulasan

Catat Ulasan